Later this month, all of the three major consumer credit bureaus will be required to offer free credit freezes to all Americans and their dependents. Maybe you’ve been holding off freezing your credit file because your home state currently charges a fee for placing or thawing a credit freeze, or because you believe it’s just not worth the hassle. If that accurately describes your views on the matter, this post may well change your mind.

Currently, many states allow the big three bureaus — Equifax, Experian and TransUnion — to charge a fee for placing or lifting a security freeze. But thanks to a federal law enacted earlier this year, after Sept. 21, 2018 it will be free to freeze and unfreeze your credit file and those of your children or dependents throughout the United States.

KrebsOnSecurity has for many years urged readers to freeze their files with the big three bureaus, as well as with a distant fourth — Innovis — and the NCTUE, an Equifax-operated credit checking clearinghouse relied upon by most of the major mobile phone providers.

There are dozens of private companies that specialize in providing consumer credit reports and scores to specific industries, including real estate brokers, landlords, insurers, debt buyers, employers, banks, casinos and retail stores. A handy PDF produced earlier this year by the Consumer Financial Protection Bureau (CFPB) lists all of the known entities that maintain, sell or share credit data on U.S. citizens.

The CFPB’s document includes links to Web sites for 46 different consumer credit reporting entities, along with information about your legal rights to obtain data in your reports and dispute suspected inaccuracies with the companies as needed. My guess is the vast majority of Americans have never heard of most of these companies.

Via numerous front-end Web sites, each of these mini credit bureaus serve thousands or tens of thousands of people who work in the above mentioned industries and who have the ability to pull credit and other personal data on Americans. In many cases, online access to look up data through these companies is secured by nothing more than a username and password that can be stolen or phished by cybercrooks and abused to pull privileged information on consumers.

In other cases, it’s trivial for anyone to sign up for these services. For example, how do companies that provide background screening and credit report data to landlords decide who can sign up as a landlord? Answer: Anyone can be a landlord (or pretend to be one).

SCORE ONE FOR FREEZES

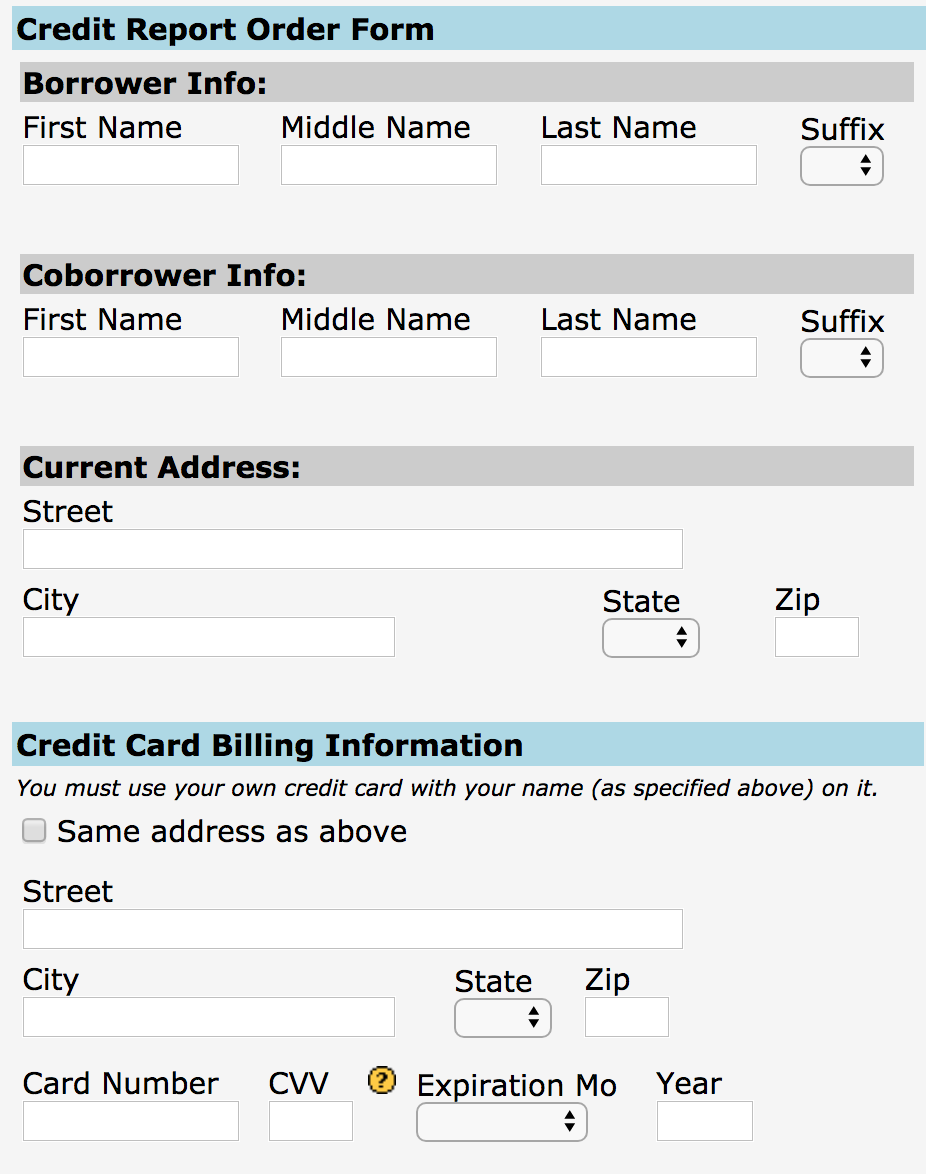

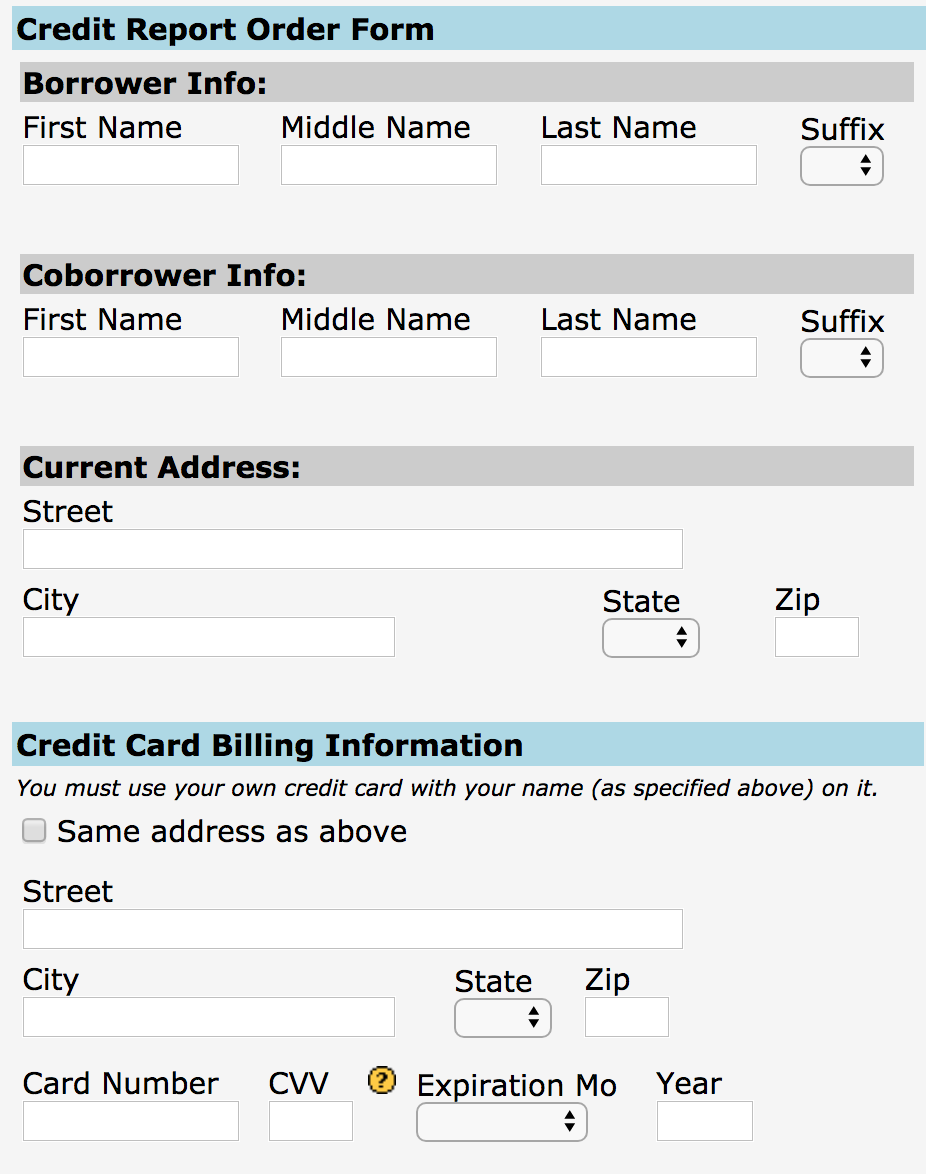

The truly scary part? Access to some of these credit lookup services is supposed to be secured behind a login page, but often isn’t. Consider the service pictured below, which for $44 will let anyone look up the credit score of any American who hasn’t already frozen their credit files with the big three. Worse yet, you don’t even need to have accurate information on a target — such as their Social Security number or current address.

KrebsOnSecurity was made aware of this particular portal by Alex Holden, CEO of Milwaukee, Wisc.-based cybersecurity firm Hold Security LLC [full disclosure: This author is listed as an adviser to Hold Security, however this is and always has been a volunteer role for which I have not been compensated].

Holden’s wife Lisa is a mortgage broker, and as such she has access to a more full-featured version of the above-pictured consumer data lookup service (among others) for the purposes of helping clients determine a range of mortgage rates available. Mrs. Holden said the version of this service that she has access to will return accurate, current and complete credit file information on consumers even if one enters a made-up SSN and old address on an individual who hasn’t yet frozen their credit files with the big three.

“I’ve noticed in the past when I do a hard pull on someone’s credit report and the buyer gave me the wrong SSN or transposed some digits, not only will these services give me their credit report and full account history, it also tells you what their correct SSN is,” Mrs. Holden said.

With Mr. Holden’s permission, I gave the site pictured above an old street address for him plus a made-up SSN, and provided my credit card number to pay for the report. The document generated by that request said TransUnion and Experian were unable to look up his credit score with the information provided. However, Equifax not only provided his current credit score, it helpfully corrected the false data I entered for Holden, providing the last four digits of his real SSN and current address.

“We assume our credit report is keyed off of our SSN or something unique about ourselves,” Mrs. Holden said. “But it’s really keyed off your White Pages information, meaning anyone can get your credit report if they are in the know.”

I was pleased to find that I was unable to pull my own credit score through this exposed online service, although the site still charged me $44. The report produced simply said the consumer in question had requested that access to this information be restricted. But the real reason was simply that I’ve had my credit file frozen for years now.

Many media outlets are publishing stories this week about the one-year anniversary of the breach at Equifax that exposed the personal and financial data on more than 147 million people. But it’s important for everyone to remember that as bad as the Equifax breach was (and it was a total dumpster fire all around), most of the consumer data exposed in the breach has been for sale in the cybercrime underground for many years on a majority of Americans — including access to consumer credit reports. If anything, the Equifax breach may have simply helped ID thieves refresh some of those criminal data stores.

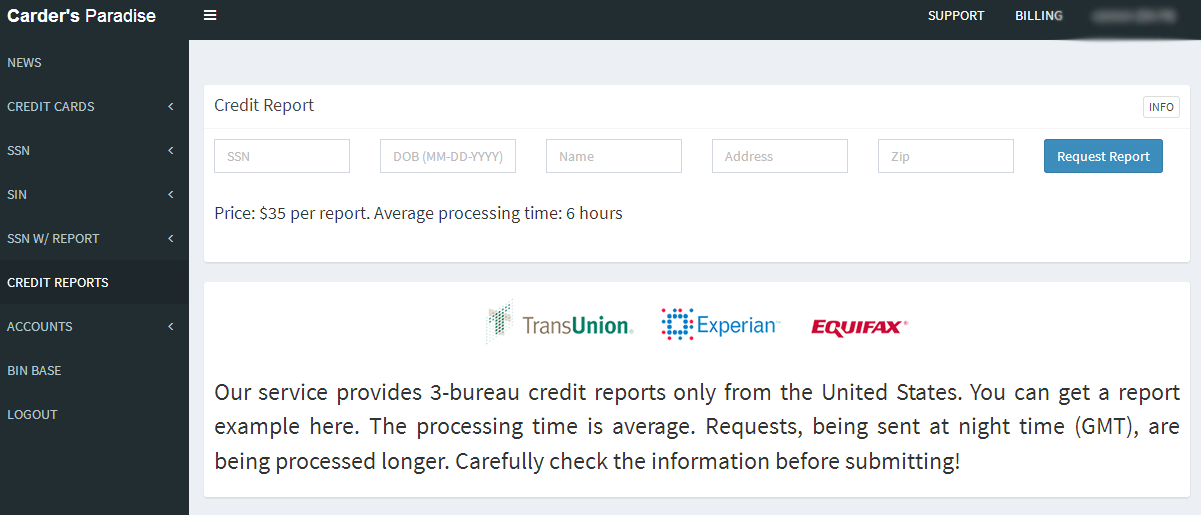

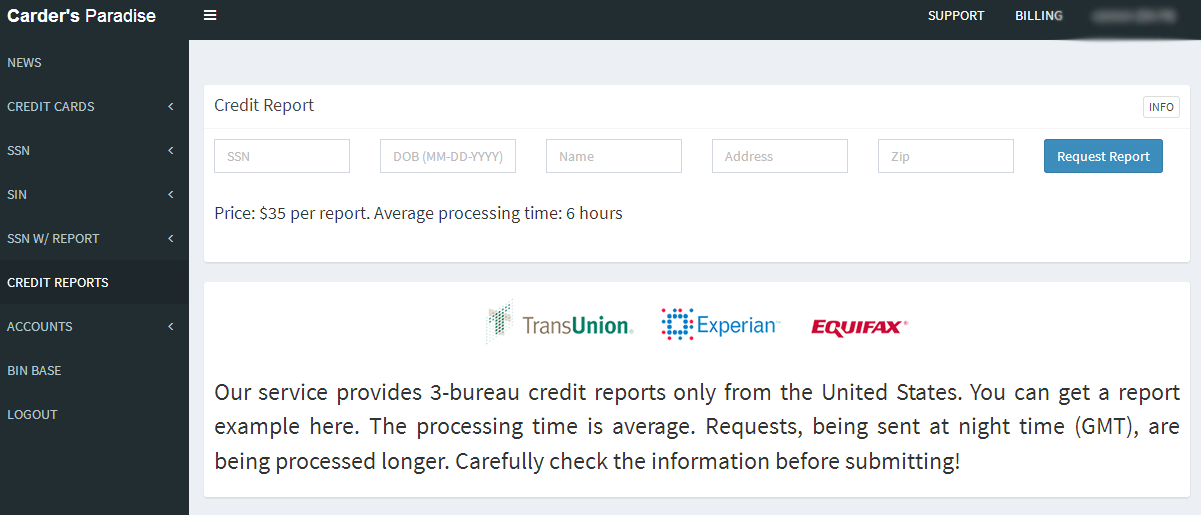

It costs $35 worth of bitcoin through this cybercrime service to pull someone’s credit file from the three major credit bureaus. There are many services just like this one, which almost certainly abuse hacked accounts from various industries that have “legitimate” access to consumer credit reports.

THE FEE-FREE FREEZE

According to the U.S. Federal Trade Commission, when the new law takes effect on September 21, Equifax, Experian and TransUnion must each set up a webpage for requesting fraud alerts and credit freezes.

The law also provides additional ID theft protections to minors. Currently, some state laws allow you to freeze a child’s credit file, while others do not. Starting Sept. 21, no matter where you live you’ll be able to get a free credit freeze for kids under 16 years old.

Identity thieves can and often do target minors, but this type of fraud usually isn’t discovered until the affected individual tries to apply for credit for the first time, at which point it can be a long and expensive road to undo the mess. As such, I would highly recommend that readers who have children or dependents take full advantage of this offering once it’s available for free nationwide.

In addition, the law requires the big three bureaus to offer free electronic credit monitoring services to all active duty military personnel. It also changes the rules for “fraud alerts,” which currently are free but only last for 90 days. With a fraud alert on your credit file, lenders or service providers should not grant credit in your name without first contacting you to obtain your approval — by phone or whatever other method you specify when you apply for the fraud alert.

Under the new law, fraud alerts last for one year, but consumers can renew them each year. Bear in mind, however, that while lenders and service providers are supposed to seek and obtain your approval if you have a fraud alert on your file, they’re not legally required to do this.

A key unanswered question about these changes is whether the new dedicated credit bureau freeze sites will work any more reliably than the current freeze sites operated by the big three bureaus. The Web and social media are littered with consumer complaints — particularly over the past year — about the various freeze sites freezing up and returning endless error messages, or simply discouraging consumers from filing a freeze thanks to insecure Web site components.

It will be interesting to see whether these new freeze sites will try to steer consumers away from freezes and toward other in-house offerings, such as paid credit reports, credit monitoring, or “credit lock” services. All three big bureaus tout their credit lock services as an easier and faster alternative to freezes.

According to a recent post by CreditKarma.com, consumers can use these services to quickly lock or unlock access to credit inquiries, although some bureaus can take up to 48 hours. In contrast, they can take up to five business days to act on a freeze request, although in my experience the automated freeze process via the bureaus’ freeze sites has been more or less instantaneous (assuming the request actually goes through).

TransUnion and Equifax both offer free credit lock services, while Experian’s is free for 30 days and $19.99 for each additional month. However, TransUnion says those who take advantage of their free lock service agree to receive targeted marketing offers. What’s more, TransUnion also pushes consumers who sign up for its free lock service to subscribe to its “premium” lock services for a monthly fee with a perpetual auto-renewal.

Unsurprisingly, the bureaus’ use of the term credit lock has confused many consumers; this was almost certainly by design. But here’s one basic fact consumers should keep in mind about these lock services: Unlike freezes, locks are not governed by any law, meaning that the credit bureaus can change the terms of these arrangements when and if it suits them to do so.

If you’d like to go ahead with freezing your credit files now, this Q&A post from the Equifax breach explains the basics, and includes some other useful tips for staying ahead of identity thieves. Otherwise, check back here later this month for more details on the new free freeze sites.

People should also remember there are things to help them keep up with there credit report.

Credit Karma and Quizzle are a couple.

via: krebsonsecurity